What Is A Cryptocurrency Exchange?

The best way of trading cryptocurrencies is through the use of cryptocurrency exchanges. Cryptocurrency exchanges are platform that facilitate the buying and selling of cryptocurrencies against other digital currencies, fiats, and NFTs.

Cryptocurrency exchanges provide a variety of trading options including but not limiting to options trading, futures, margin, p2p and much more.

Below, we will look at the main types of cryptocurrency exchanges.

Types of Crypto Exchanges.

Centralized Cryptocurrency Exchange (CEX).

A centralized cryptocurrency exchange or centralized exchange or CEX for short is a platform that act as an middleman between buyers and sellers of cryptocurrencies. These exchanges make money through commissions and transaction fees. A CEX can be seen as a stock exchange for cryptocurrencies.

Popular centralized cryptocurrency exchanges include; Binance, Coinbase Exchange, Bybit, Kraken and KuCoin. Much like stock trading platforms, these exchanges allow cryptocurrency investors to buy and sell digital assets. These assets can be traded at a prevailing price (spot trading) or, the trader can place an order that will get executed when the asset reaches the desired order price (Limit order).

CEXs operate using an order book system, which means that buy and sell orders are listed and sorted by the intended buy or sell price. The matching engine of the exchange then matches buyers and sellers based on the best executable price given the desired lot size. Hence, a digital asset’s price will depend on the supply and demand of that asset versus another, whether it be fiat currency or cryptocurrency.

CEXs decide which digital asset it will allow trading in, which provides a small measure of comfort that scam digital assets may be excluded from the CEX.

Decentralized Cryptocurrency Exchange (DEX).

Unlike centralized exchanges, a decentralized cryptocurrency exchange or just a decentralized exchanges or DEX for short is, completely autonomous and allow users complete control of their funds without any oversight. It is a peer-to-peer marketplace with direct transactions occurring between traders. They are more secure and private than CEX. DEXs like Uniswap use decentralized finance (DeFi) tools, which allow a large range of financial services available to compatible crypto wallets. A potential drawback is that these exchanges have lower liquidity than centralized exchanges.

Hybrid Cryptocurrency Exchange.

Hybrid cryptocurrency exchanges also known as Hybrid exchanges, combine both the CEX and DEX functionalities. They offer the convenience of centralized exchanges while maintaining the privacy of decentralized exchanges. These are relatively new concepts that are still gaining traction among crypto investors.

3 Best Cryptocurrency Exchanges.

Best Centralized Cryptocurrency Exchanges (CEX).

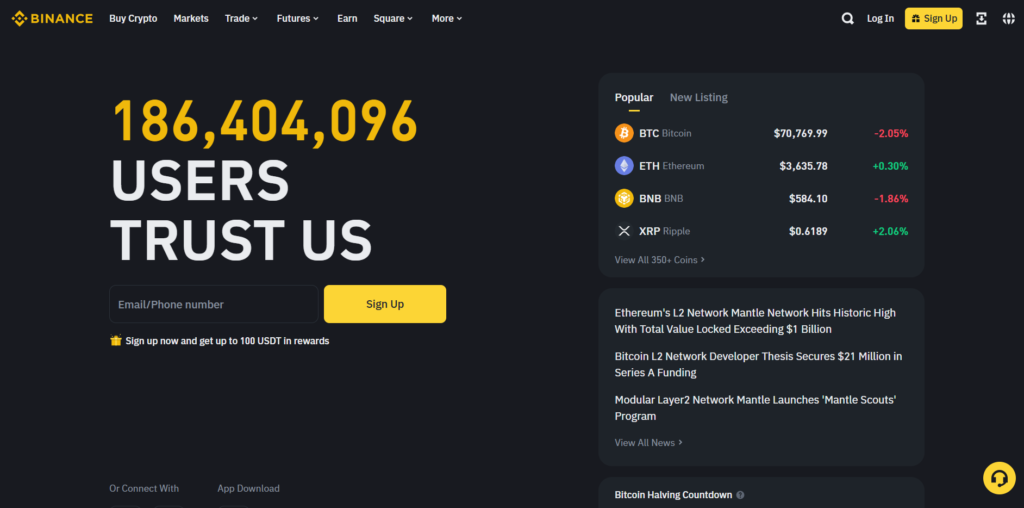

Binance.

Binance is the leading centralized cryptocurrency exchange with a trust exchange score of 9.9 and over 406 coins based on cmc stats of march 2024. It supports a majority of fiats such as USD, EUR, GBP and more. It has an exceptional p2p trading market handling multiple cryptocurrencies and fiats.

Coinbase Exchange.

Coinbase Exchange runs second to Binance with a trust exchange score of 8.2 and over 243 coins based on cmc stats of march 2024. It supports the fiats USD, EUR, GBP.

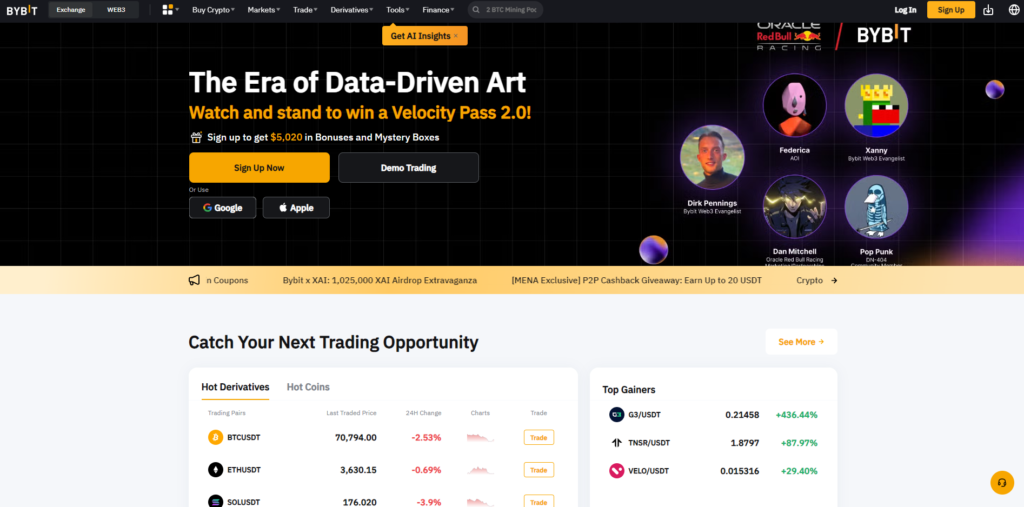

Bybit

Bybit is the third best centralized cryptocurrency exchange, and it has a trust exchange score of 7.8 with over 592 coins based on cmc stats of march 2024. It supports fiats like USD, EUR, GBP and more. Bybit also has a p2p trading platform.

Best Decentralized Cryptocurrency Exchanges (DEX).

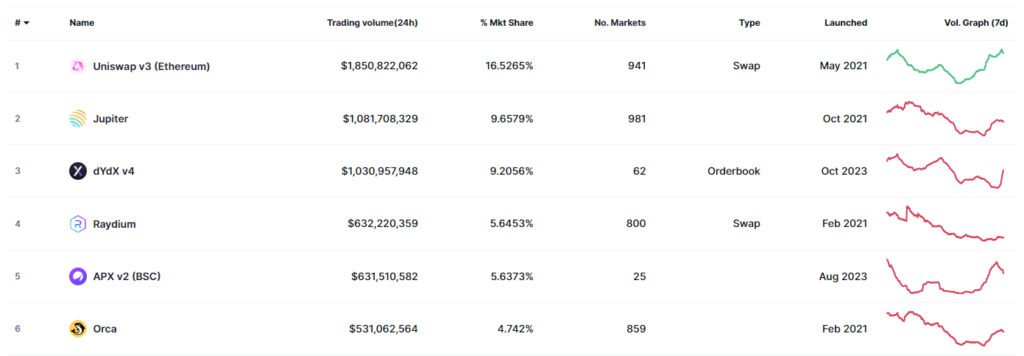

Uniswap V3.

Uniswap is the first Decentralized cryptocurrency exchange on the list. Launched in November 2018, it pioneered the automated market maker (AMM). It runs on the Ethereum blockchain and uses a number of smart contract for secure swapping of ERC-20 tokens between users.

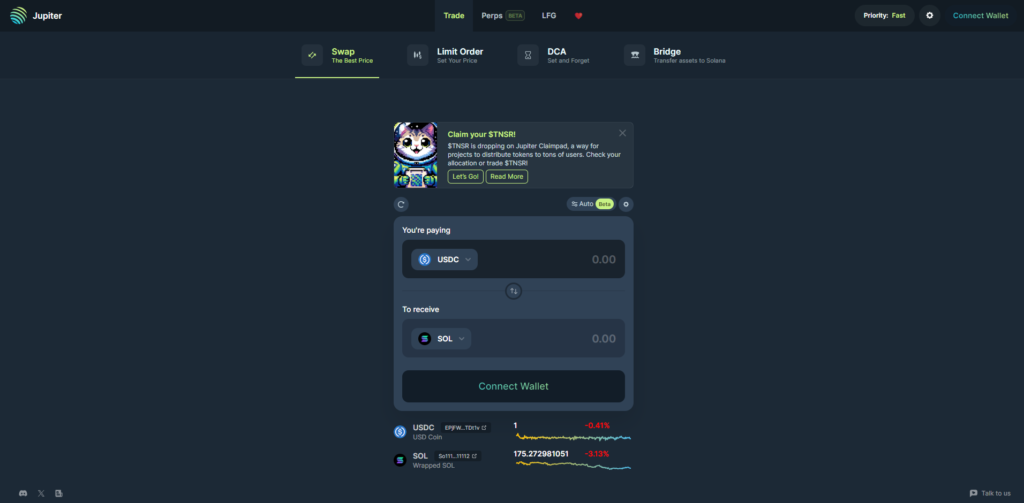

Jupiter.

Jupiter is a liquidity aggregator on Solana. According to coinmarketcapital, jupiter aggregates the best token prices across different decentralized exchanges by connecting all DEX markets and AMM pools together, irrespective of the provider.

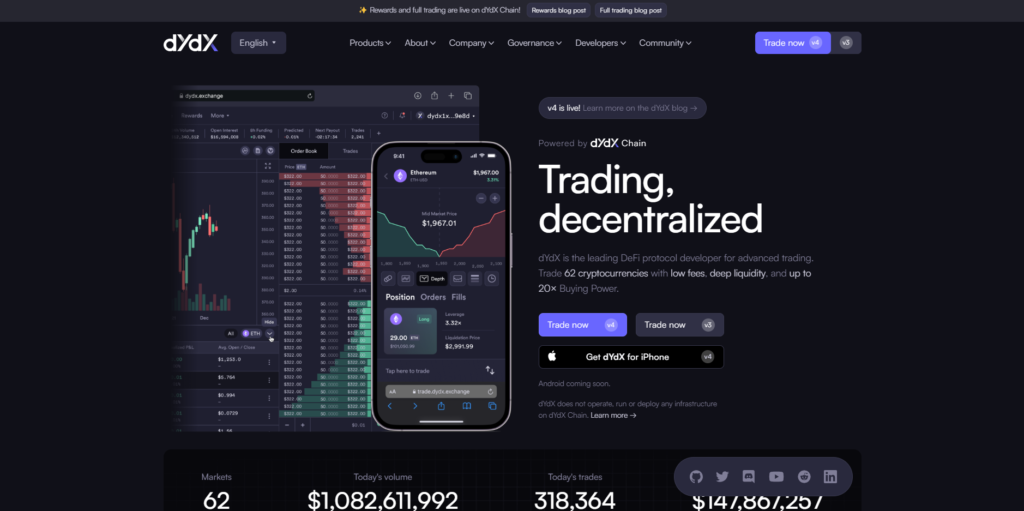

dYdX V4.

dYdX v4 is the third decentralized exchange on the list. According to coinmarketcapital, it uses the dYdX Chain (a proof-of-stake blockchain network built using the Cosmos SDK and leveraging CometBFT for consensus) which provides, full decentralization of the orderbook and matching engine, enhanced reward systems for users and community members, and much more.

Helpful Cryptocurrency Exchange Guides?

We have searched the internet and looked for helpful beginner guides to get you started on cryptocurrency exchanges. As always, these resources are meant to better educate you, enhancing your understanding of cryptocurrencies.